Every year, the SBI recruitment is one of the biggest competitive exam that is held to fill Probationary Officer & Clerks. But the eligibility for SBI jobs are quite different in many ways including some new rules being introduced for applicants. One of it is related to loans & credit card dues wherein candidates who had defaulted in repayment are ineligible to apply for clerical or PO recruitment in SBI.

State Bank of India being the largest public sector bank in India is also one of the biggest employment generator in banking sector.It is the reason why every bank job aspirant in India looks forward for jobs to be announced by SBI.

While the recently released SBI PO recruitment 2021 notification has increased the hopes of candidates, they are also concerned about some conditions.

SBI Clerk & PO Recruitment: 2 New Rules to Note

There are certain eligibility conditions for candidates to fulfil if they wish to apply for SBI PO or SBI junior associate posts.

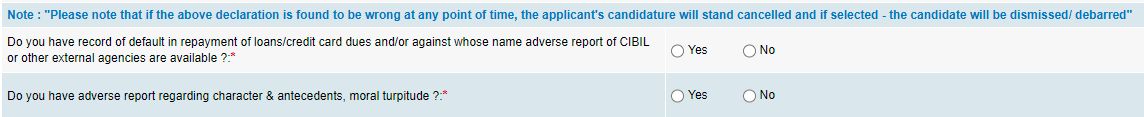

In addition to the normal criteria, there are two new rules which many would have seen in the online application form:

1) Repayment of Loans: State Bank of India, a popular public sector bank is asking about the candidate`s credit history for recruitment.In their official notification, SBI says,

“Candidates with record of default in repayment of loans/credit card dues and/or against whose name, adverse report of CIBIL or other external agencies are available are not eligible for appointment.”

It simply means – If you had taken education loan/ home loan/ vehicle loan/ personal loan/ credit card loan & are not repaying it regularly or defaulted (missed) repayment – you are not eligible to apply for these PO posts.

Even if you had availed loans from any other bank & not repaying it regularly, SBI will still not allow you to join their bank.

How loan repayment affects you?

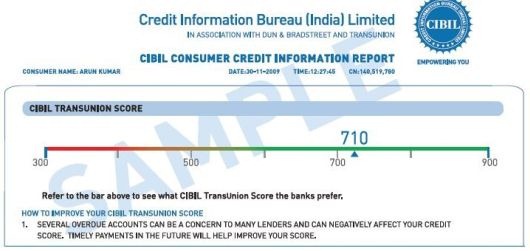

CIBIL (Credit Information Bureau) is the company that keeps track of every individual`s repayment record of loans. This information is provided to them by banks & other financial institutions every month.

With this info, CIBIL creates a credit report & provides scores (also called CIBIL score)for every person who availed a loan.

- If you are paying the EMI/ dues promptly without any delay, your score would increase, placing you in safe zone.

- Incase you are defaulting in repaying the loan regularly or has not repaid the loan/ credit card dues fully for a long time, your CIBIL score is lowered.

A low credit score means bad credit history.

No bank will offer you any loans the next time & even if they do sanction, it would be at a much higher rate of interest.

How SBI is going to use CIBIL score?

State Bank of India has not detailed the exact manner on how they intend to use credit score data in recruitment.But they look very serious to not allow loan defaulters to become their employees.

The possibility is, SBI may verify the CIBIL scores of selected candidates before appointment as part of their background verification process, just like private banks

2) Complaint Against Your Character: This is another criteria that we are seeing in SBI recruitment application form. Here is the exact condition from their advt:

“Candidates against whom there is/are adverse report regarding character & antecedents, moral turpitude are not eligible to apply for the post.

It means – Those who are having bad conduct character report in their name are not eligible to apply for these jobs.

Any pending police case or enquiry filed on account of bad behavior would also come under this category.With increasing number of frauds reported in banks, SBI doesnt want to take any chances & prefers to hire people with clean records only.

Although there was opposition from public over this condition since last year, the SBI PO recruitment 2021 notification also restricts loan defaulters from applying!

Many candidates had taken educational loans but couldn’t repay it on time due to unavailability of jobs. With these rules, young unemployed graduates are going to find it tough to appear for SBI jobs & recruitments as well.

Will other banks also implement such a restriction or not will be known after the IBPS bank exams are announced.