Have you got selected in a public sector bank in the latest IBPS recruitment?Then there are service bond agreements that need to be understood that include certain rules related to probation, minimum service period & amount to pay.With candidates getting ready to join their allotted bank, we have collected those details for you in advance to prepare them early..

Have you got selected in a public sector bank in the latest IBPS recruitment?Then there are service bond agreements that need to be understood that include certain rules related to probation, minimum service period & amount to pay.With candidates getting ready to join their allotted bank, we have collected those details for you in advance to prepare them early..

Public sector banks to increase their business and compete with private sector banks have started opening new branches across the nation.To stop employees from moving out frequently, there are service bonds in govt banks too.

For the year 2016-17, IBPS had recently announced allotments for 12600 PO jobs, 24,600 clerk jobs & 4300 Specialist officer jobs.

Service Bond in Banks

If you are new to bank jobs, then the following question will come up in your mind sooner or later.

What is a Bond & what will happen if I break it?

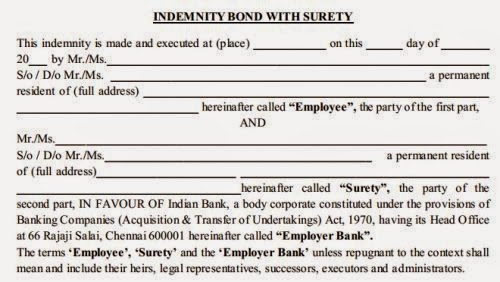

A service bond is an agreement that candidates will have to sign at the time of joining agreeing to serve the bank for a minimum period (2 or 3 years).

Incase they quit or resign before the specified duration, that individual has to pay the pre-specified amount.This is also called Indemnity bond.

| Note:Only those selected for PO (officer – scale I) & SO (Specialist officer) are required to sign service bonds.It is not required for clerk posts. |

So for the first time ever we present a list containing details about the service bond conditions in public banks..

| Service Bond in Indian Public Sector Banks | ||

|---|---|---|

| Bank Name | Bond Period | Bond Amount |

| Allahabad Bank | 3 years | Rs. 1,00,000 |

| Andhra Bank | 3 yrs | Rs. 2,00,000 |

| Bank of Baroda | No bond | |

| Bank of India | data not available | |

| Bank of Maharashtra | 2 yrs | Rs. 1,00,000 |

| Canara Bank | 2 yrs | Rs. 25,000 |

| Central Bank of India | not available | |

| Corporation Bank | 2 yrs | Rs. 50,000 |

| Dena Bank | 3 yrs | Rs. 1,50,000 |

| IDBI Bank | not available | |

| Indian Bank | 2 yrs | Rs. 1,00,000 |

| Indian Overseas Bank | 3 yrs | Rs. 1,00,000 |

| Oriental Bank of Commerce | not available | |

| Punjab National Bank | 3 yrs | Rs. 2,00,000 |

| Punjab & Sind Bank | 3 yrs | Rs. 50,000 |

| Syndicate Bank | 2 yrs | Rs. 1,00,000 |

| UCO Bank | 2 yrs | Rs. 2,00,000 |

| Union Bank of India | 3 yrs | Rs. 2,00,000 |

| United Bank of India | 3 yrs | Rs. 1,00,000 |

| Vijaya Bank | 3 yrs | Rs. 2,00,000 |

| EXIM Bank | data not available | |

| ECGC | 3 yrs | 3 – 5 months salary |

| Bharatiya Mahila Bank | data not available |

Data in the above tabulation were collected from recruitment notices issued by corresponding banking organizations.It is possible for them to modify these requirements while recruiting for current or future vacancies.

Doubts About Service Bond Agreements

There could be some who might not understand certain sections in the list.For their benefit, answers for commonly asked questions pertaining to bond agreements in public sector banks can be found below.

Is there any format for bond agreement?

The bank to which you are allotted will provide you with a format.

It will contain the words that has to be exactly reproduced onto a legal document (stamp paper)

The below image is of an indemnity bond format.Once the joining dates are announced, you can download this document from the bank`s website.

Should I pay the bond amount in advance?

Not required.The specified value should be paid to the bank only if you resign from service before completing the minimum service period.

We hope this compilation from BankExamsIndia.com will help you in comparing the joining conditions for all the public sector banks in India.

In case you have questions related to the service bonds, ask it through the form below.